Revolut Points Comparison

I've been analyzing Revolut's points system, comparing debit and credit cards, and I found some interesting insights worth sharing.

To make it easier to understand, I created a table showing how many points you earn for every €10 spent, depending on your plan:

| Plan | Debit | Credit |

|---|---|---|

| Standard | 1 | 1 |

| Plus | 1 | 1.5 |

| Premium | 2.5 | 3.75 |

| Metal | 5 | 10 |

| Ultra | 10 | 15 |

As you can see, the difference between plans is significant: from 1 point up to 15 points per €10 spent — that’s a 15x difference.

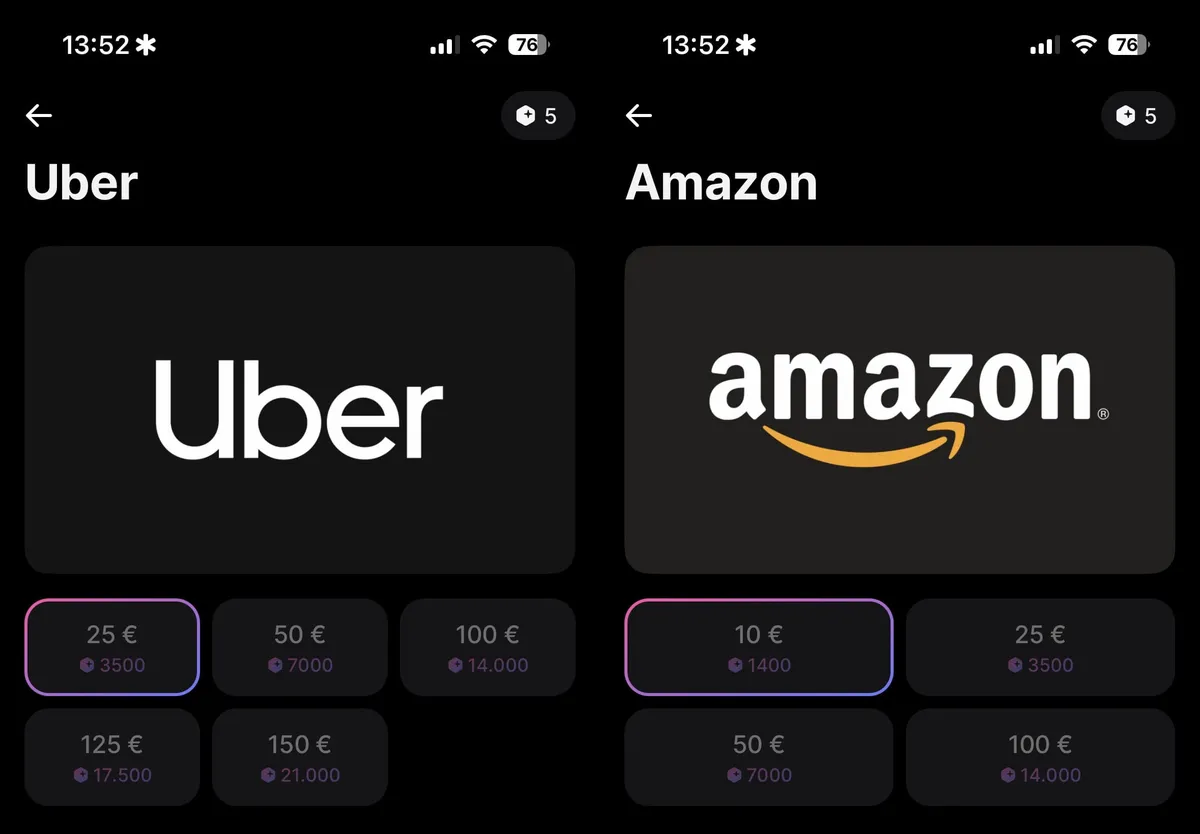

But here’s the catch: points don’t have a fixed value. Their worth depends on ongoing promotions or brand partnerships, meaning you need to regularly check the app to make the most of them.

To make a more objective comparison, I used a stable benchmark: gift cards, which have a consistent exchange rate across all brands.

The conversion rate is: 140 points = €1.

Based on that, here’s the actual cashback percentage for each plan:

| Plan | Debit | Credit |

|---|---|---|

| Standard | 0.07% | 0.07% |

| Plus | 0.07% | 0.11% |

| Premium | 0.18% | 0.27% |

| Metal | 0.36% | 0.71% |

| Ultra | 0.71% | 1.07% |

These returns are relatively low if you don’t factor in promotional offers.

What’s more interesting is calculating how much you need to spend each month to earn a €10 gift card with the points you get. In other words, how much spending is required for the points to reach that reward:

| Plan | Monthly Fee | Spend Needed for €10 (Debit) | Spend Needed for €10 (Credit) |

|---|---|---|---|

| Standard | Free | €14,000 | €14,000 |

| Plus | €3.99 | €14,000 | €9,300 |

| Premium | €8.99 | €5,500 | €3,700 |

| Metal | €15.99 | €2,800 | €1,400 |

| Ultra | €55.00 | €1,400 | €900 |

The only setup that comes close to justifying its monthly cost through points alone is the Metal plan with a credit card.

Of course, there are other perks to consider, like interest on savings, insurance, or travel benefits. But if your main motivation is earning points, this breakdown should help you decide whether upgrading is truly worth it.